As a healthcare leader, you closely track economic and market trends in your segment to make strategic decisions. But hearing perspectives of other leaders in your sector can also be helpful. DLL recently hosted a European customer panel for a select group of strategic healthcare partners. The purpose: assess the macro level impact of COVID-19 and share approaches for addressing its challenges in various healthcare segments.

“A session like this is ingrained in our partnership DNA,” said John Sparta, President Global Business Unit, Healthcare and CleanTech at DLL as he kicked off the panel. “As we go through a crisis like this COVID-19 pandemic, we are all really focused on how we can strengthen each other. Our purpose is to share information that our customers might not have access to and discuss some of the things happening in the markets to learn from each other. It also gives us insight into how we can best support our partners.”

Since healthcare is so heavily affected by the COVID-19 pandemic, this was a deep dive panel with five healthcare partners across different healthcare segments: medical imaging, surgical, dental, aesthetics, and wellness & fitness.

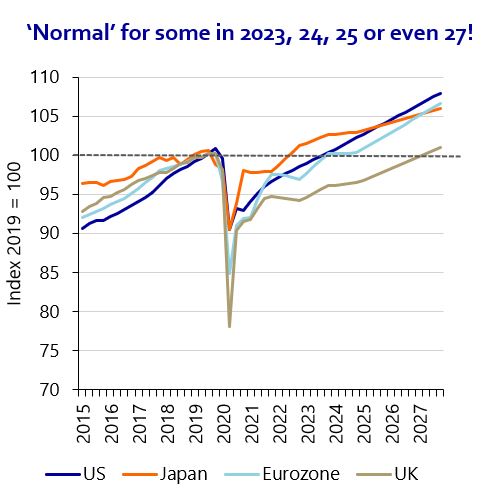

COVID-19 shock – the long and winding road back to the Next Normal

Elwin de Groot, Head of Macro Strategy at Rabobank Group gave his views on the macro economic trends ahead and how they will affect the healthcare sector in the short and long-term. The good news is that the arrival of effective vaccines in 2021 is giving companies the perspective of returning to ‘normality’. Monetary and fiscal policy support has successfully staved off a much-feared demand shock to the economy.

Having said this, De Groot continues: “People are already dealing with a second wave of COVID-19. Plus, the crisis in 2020 has added to the long-term implications: technological developments have accelerated, spurring new business models, and offering new opportunities for growth. At the same time, the world is exiting this crisis with even more debt and a sharp increase in ‘zombie companies’, which are deeply in debt but kept alive by receiving financial support. Many employees in healthcare and other sectors are also suffering from high and long-lasting levels of stress. All of this is likely to weigh on the world’s future economic growth potential.”